Our Investment Approach

Harnessing Expertise.Driving Innovation.

A Team Built for

Today’s Markets

At Procyon, exceptional outcomes begin with exceptional people. Our in-house investment team is composed of specialists in asset allocation, trading, portfolio management, and quantitative research – all united in helping our clients navigate dynamic market environments.

Our team oversees every aspect of the investment process from research and strategy design to trading and implementation clients benefit from solutions that are thoughtful, adaptive, and grounded in real expertise. Each of our advisors works directly with our investment team to design bespoke, customized solutions for each unique client situation.

Decades of

Experience. One

Shared Mission.

Led by Chief Investment Officer Antonio Rodrigues and Director of Investments Mark Rich, our investment team brings together institutional experience and direct client engagement. Through one-on-one meetings, monthly market commentary, and educational webinars, the team provides clients with real-time insights and meaningful communication. The team’s experience extends from broad asset allocation to concentrated equity optimization strategies.

We offer value-added investment opportunities such as access to private investment funds for qualified purchasers – with no additional management fees.

Introducing Alpha

Quant Our

Proprietary

Equity Management

Team

Alpha Quant, Procyon’s dedicated independent research team, specializes in model portfolios and proprietary indexes designed to capture alpha through systematic equity strategies. Guided by industry experts Massimo Santicchia and Katherine Gallagher, the team brings decades of expertise in equity research, quantitative analysis, asset allocation, and manager evaluation.

With a disciplined approach, Alpha Quant manages strategies across the full style box spectrum, encompassing large-cap, mid-cap, and small-cap equities. The team boasts a distinguished track record of 15 years in large-cap strategies and 8 years in mid- and small-cap investments- demonstrating a commitment to consistency and innovation.

Among its notable achievements, Alpha Quant’s Large Cap Value SMA (Separately Managed Account) has earned the prestigious “Top Guns Manager of the Decade” designation from PSN Informa for four consecutive years, underscoring its excellence in delivering superior results.

Our Approach – Collaborative, Disciplined, and Data-Informed.

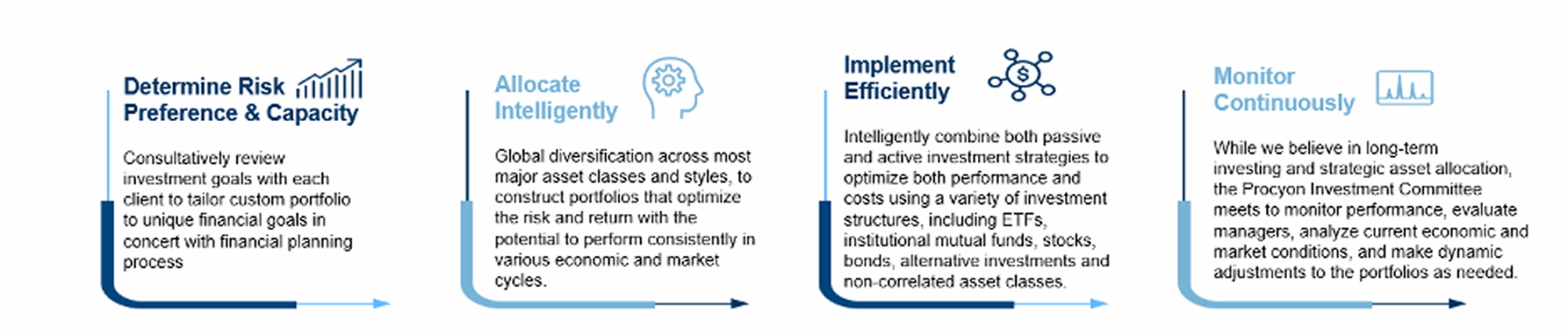

Procyon’s investment management framework is structured to ensure every client portfolio is overseen with care and precision. Our portfolio managers and analysts work in tandem with wealth managers to build and adjust allocations, using insights gathered from dedicated committees that bring together diverse expertise.

This collaborative model ensures that every portfolio benefits from multiple perspectives, rigorous oversight, and alignment with the client’s objectives.

Experience

the Procyon

Difference

Discover how our in-house team backed by award-winning research and quantitative innovation can help you build a investment strategy.