15 Oct U.S. Macro and Market Commentary

Third Quarter in Review:

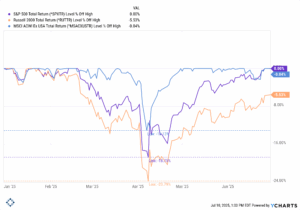

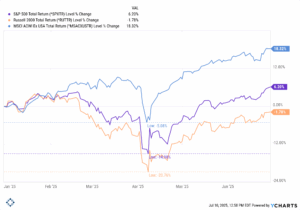

- US equities moved higher in the quarter and are now up substantially year to date.

- Within large caps, the S&P 500 was up 8.1% in the quarter and now up 14.8% year to date.

- Small cap stocks were even stronger in the quarter, up 12.4%, but continue not trail large cap stocks this year.

- International equities continued to perform extremely well with a tailwind of the weakening US dollar. These names were up 7% in the quarter and now up 26.6% year to date.

- Fixed income markets produced nice returns as well, with taxable bonds up 2% and municipal bonds up 3% in the quarter. Year to date, taxable bonds have outpaced municipal by 350bps (6.13% vs 2.64%) as municipals have ran into technical headwinds.

- The rally we have experienced over the last five months (since the tariff-related market sell-off) has been strong and wide range. In the rest of this write-up, we hope to outline our views on current economic data and our expectations going forward.

Economic Growth — Stabilizing, but still below trend

- The U.S. economy shows early signs of bottoming, though expansion is not yet broad-based.

- Manufacturing PMI edged up to 49.1, its highest in eight months, signaling slower contraction.

- Production moved back into expansion (51.0), but new orders (48.9) remain weak, pointing to uneven demand.

- Backlogs and exports remain soft, suggesting a late-downturn / early-recovery phase.

- Services PMI held near 50.0, signaling stagnation. Business activity cooled, and hiring slowed, while prices (69.4) remained elevated — evidence that inflation pressures persist even as growth moderates.

- Bottom Line: growth momentum is stabilizing, but the U.S. remains below trend and dependent on liquidity support.

Inflation — Re-accelerating and not yet re-anchored

- Headline CPI has firmed to 2.9% year-over-year, with core CPI around 3.1%, driven by sticky shelter costs and new tariff effects.

- The short-term annualized pace (3.5–3.7%) signals an inflation upswing, complicating the Fed’s easing trajectory.

- Price pressures are most evident in services and housing, while goods inflation remains subdued.

- Bottom Line: inflation has plateaued above the Fed’s comfort zone – it’s falling, but not fast enough to rule out policy risk.

Federal Reserve Policy — Transitioning from restrictive to reactive

- The Fed funds rate, near 4.0%, remains modestly restrictive in real terms but is moving toward a data-dependent easing stance.

- The yield curve (10Y–3M) has finally turned positive (+0.14%) after two years of inversion — a potential late-cycle pivot that historically signals recession risks are fading.

- Markets expect further cuts into 2026, but that depends on the trajectory of inflation.

- Bottom Line: policy risk remains two-sided; if inflation stalls above 3.5%, cuts could pause; if growth weakens again, cuts may accelerate.

Market Behavior — Liquidity overtaking fundamentals

- Despite soft macro data, U.S. equities continue to rally. The S&P 500 hit record highs (6,740), driven by AI-related mega-cap strength and expectations of policy easing.

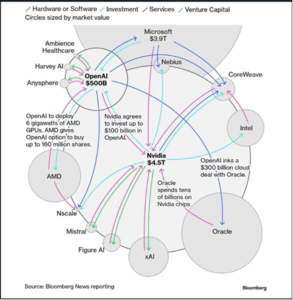

- As shown in Bloomberg’s AI network chart, OpenAI, Nvidia, Microsoft, Oracle, and AMD form a dense investment web — billions in cross-investments, GPU spending, and cloud deals are reinforcing a liquidity-driven growth narrative even as real economic indicators lag.

(Bloomberg AI Investment Network — October 2025)

-

- Nvidia has pledged up to $100 billion in OpenAI.

- OpenAI struck a $300 billion cloud deal with Oracle and is deploying 6 GW of AMD GPUs.

- Microsoft, Oracle, and others are deeply embedded across both the hardware and software layers of the AI economy.

- This ecosystem has become the core engine of equity market capitalization growth, with the AI “infrastructure trade” supporting valuations even as underlying profits flatten.

Earnings and Valuation — Narrow, expensive, and fragile

- S&P 500 forward P/E stands at ~23x, near post-COVID highs, supported by rate-cut expectations rather than strong earnings growth.

- Free cash flow yield is near record lows at ~2%, below investment-grade bond and Treasury yields — implying a compressed equity risk premium.

- Earnings concentration remains extreme:

- The “Mag7” account for ~33% of market cap but only ~25% of EPS (OP/MKT ≈ 0.77).

- Financials, Energy, and Communication Services are over-earning relative to size, while Tech’s earnings share lags its valuation weight.

- With PMIs below 50 and margins peaking, equities are vulnerable to multiple compression if growth or earnings disappoint.

Risk Environment — Improving tone, fragile balance

- Our proprietary risk composite shows a mild uptick (+0.64), signaling rising but contained risk.

- Volatility and liquidity metrics have improved since Q2, but policy and geopolitical uncertainty remain dominant.

- Financial markets are loosening ahead of policy, with equities and credit spreads reflecting early-recovery optimism, even as credit growth and small business lending stay weak.

Why Markets Rally Despite Late-Cycle Signals

- Markets lead the economy — investors are pricing an early recovery 6–9 months ahead.

- Liquidity beats macro — easing and slower quantitative tightening lowers discount rates, inflating valuations.

- Performance chasing — defensive managers are re-risking amid FOMO-driven rallies.

- Narrative power — the “Soft Landing + AI Productivity + Fed Put” story coupled with a stock market motivated government, keeps sentiment high.

- Valuation-driven rally — EPS growth is flat, but higher P/Es lift index levels, echoing prior “liquidity repricing” cycles (1995, 2019).

Our Outlook — Policy-led stabilization with valuation risk

- Base case: sub-trend growth (~1.5–2.0%), mild disinflation, and ongoing Fed easing into 2026.

- Best case: inflation falls faster, enabling more cuts and sustained AI-led capex momentum.

- Risk case: inflation re-accelerates; yield curve steepens for the wrong reasons (higher term premia).

- Positioning view:

- We remain constructive but cautious given valuations.

- We prefer quality balance sheets and cash flow visibility over speculative beta.

- We are watching for data reversion once shutdown-delayed releases resume.

In short:

- Markets are celebrating rate cuts and AI optimism, not broad economic strength.

- Growth is stabilizing but fragile; inflation is sticky; policy is reactive; valuations are stretched.

- When real data resumes, volatility could rise as sentiment meets fundamentals.

Sources:

Procyon Macro & TAA Review; Bloomberg; Reuters; Federal Reserve