09 Feb From Disinflationary Growth to a Broader Expansion

EXECUTIVE SUMMARY

The U.S. economy is transitioning from a narrow, services-led disinflationary expansion to a broader growth regime marked by a manufacturing rebound, persistent inflation friction, and an expansion of corporate earnings participation. After a prolonged contraction, manufacturing activity has re-entered expansion, driven by a decisive recovery in demand.

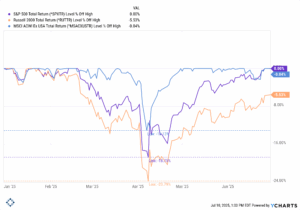

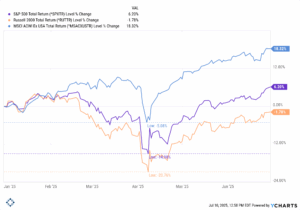

Financial markets reflect this shift: the yield curve has re-steepened on improving growth expectations, and the “earnings gap” between mega-cap tech and the broader market is closing. This regime favors cyclical participation and disciplined factor rotation over duration-driven valuation expansion.

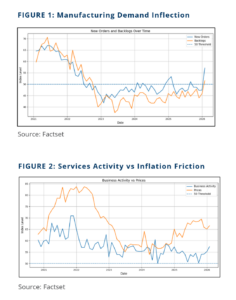

MANUFACTURING: A DEMAND-LED INFLECTION

The January manufacturing PMI rose to 52.6, marking a clear exit from contraction. This rebound is supported by New Orders at 57.1 and Backlogs at 51.6, confirming that demand acceleration is genuine rather than inventory-driven.

Historically, the simultaneous rise of New Orders and Backlogs above 50 has preceded acceleration in industrial production. While manufacturing employment remains cautious (48.1), the surge in orders suggests a transition from a services-only expansion toward a more balanced growth mix.

SERVICES: RESILIENT, BUT INFLATION-CONSTRAINED

Services activity remains firmly expansionary (PMI 53.8). However, prices paid surged to 66.6, indicating re-accelerating cost pressures. Unlike traditional demand-pull inflation, current services inflation is increasingly structural, driven by labor shortages in specialized sectors and rising energy intensity from AI-related infrastructure. These indices suggest that inflation is stabilizing above target, creating an asymmetric environment that constrains Federal Reserve easing.

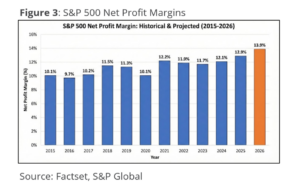

The Corporate Earnings Outlook: Breadth Returns

The macro shift into manufacturing and resilient services is manifesting in a significant broadening of corporate fundamentals. For the full year 2026, S&P 500 earnings growth is projected at 14.1%–15.0%, marking what would be the third consecutive year of double-digit gains.

Closing the “Earnings Gap”

The defining characteristic of 2026 is the participation of the broader market. While the “Magnificent 7” continue to lead with 22.7% projected growth, the S&P 493 (the rest of the index) is expected to accelerate to 12.5%. This would confirm that the earnings recession for mid-to-large-cap cyclicals has effectively ended.

Margin Resilience & Productivity

Despite rising input costs, net profit margins are forecasted to reach a record 13.9%. This is driven by two primary factors:

-

-

- AI Implementation: Transitioning from pilot stages to production-level automation in manufacturing and back-office functions.

- Pricing Power: Specifically in the Industrials and Materials sectors, where companies are successfully passing through costs as demand outstrips supply.

-

Monetary Policy and the Yield Curve

The yield curve’s re-steepening to approximately +55 bps (10y–3m) reflects growth-driven dynamics rather than policy accommodation. With growth broadening and input-cost pressures elevated, aggressive easing risks reigniting inflation. The most likely policy path is “higher-for-longer” rates with gradual, data-dependent cuts.

With Chairman Powell’s term at the Federal Reserve ending in May, President Trump’s pick to replace him, Kevin Warsh, is likely to take over. Warsh is viewed as a more financial market friendly pick, but will undoubtably have to toe the line between further accommodation and rising inflation risks.

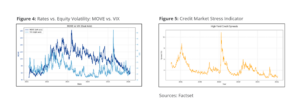

Market Volatility and Risk Regime

Market signals confirm an orderly transition. Equity volatility has risen modestly but remains below systemic risk levels. Bond market volatility is near historical troughs, indicating rate uncertainty is well-anchored. Credit spreads remain comfortably below stress thresholds, signaling rotation within risk assets rather than a broad exit from the market.

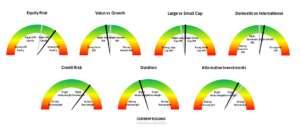

Translating the Regime into Equity Portfolio Construction

This macro regime – broadening growth with inflation friction – calls for a rotation toward “Earnings Realization” over “Valuation Expansion.”

- Reduce Concentration in Long-Duration Growth: High valuations and discount-rate sensitivity limit upside in mega-caps.

- Increase Selective Exposure to Cyclicals & Value: Specifically, Industrials and Materials, which benefit from manufacturing momentum and have seen positive earnings revisions of 28.6%.

- Broaden Market Cap Participation: Mid- and small-cap equities offer greater sensitivity to domestic growth and less reliance on multiple expansion.

- Maintain Quality as an Anchor: Emphasize profitability and balance-sheet strength to navigate a “higher-for-longer” interest rate environment.

Conclusion

The U.S. economy is entering a new phase defined by manufacturing re-engagement and an earnings recovery that is finally reaching the broader index. For investors, the challenge is not an imminent recession but adapting to a world where returns depend less on the Federal Reserve and more on earnings delivery, factor rotation, and industrial productivity.